Spot Bitcoin exchange-traded funds (ETFs) in the United States experienced their second-largest inflow day in history, with the recent crypto rally propelling Bitcoin to a new all-time high.

According to CoinGlass data, the 11 U.S. listed spot Bitcoin ETFs received a total of $1.18 billion in inflows on Monday, their largest day since November 7, 2024, when Donald Trump’s election victory triggered a wave of institutional buying and ETFs received $1.37 billion.

The increase in demand occurred as Bitcoin reached a new high over $126,000, boosting October’s total ETF inflows to $3.47 billion in only four trading days.

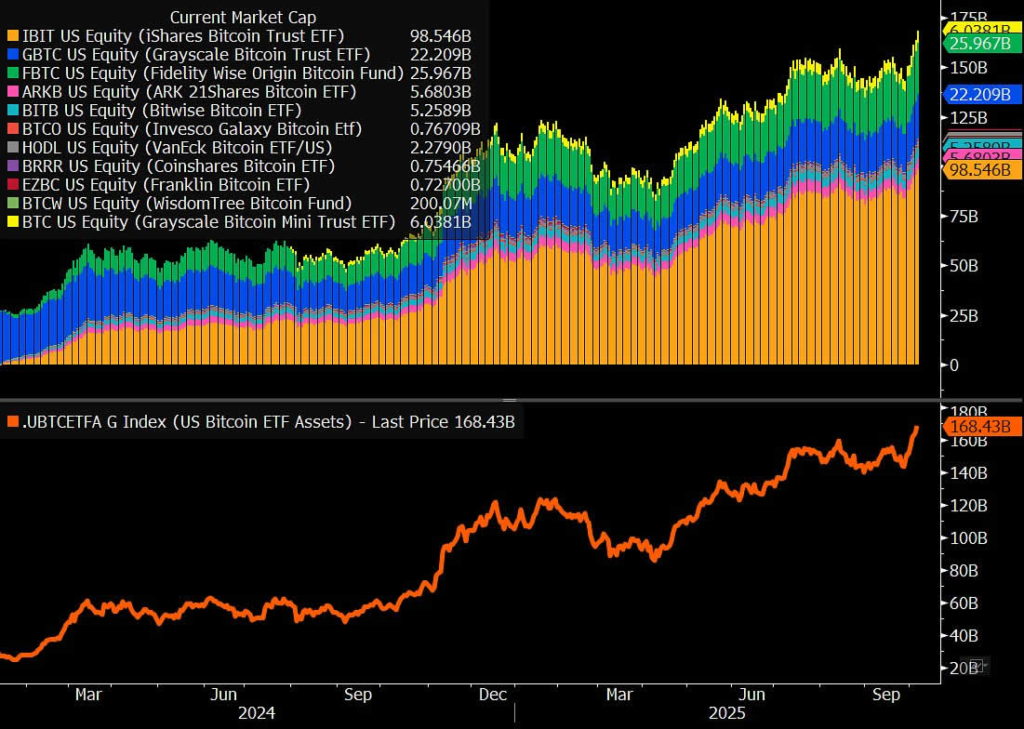

Since their inception, US Bitcoin ETFs inflows have received roughly $60 billion in total inflows, indicating a significant wave of institutional interest in digital assets, according to Bloomberg ETF analyst James Seyfart.

BlackRock’s IBIT dominates with $967 million in one day

The BlackRock iShares Bitcoin Trust (IBIT) once again led the market, accounting for the majority of Monday’s inflows ($967 million). This brings IBIT’s total inflows for October to approximately $2.6 billion, reaffirming its dominant position among spot Bitcoin ETFs.

Other major funds experienced notable gains:

- Fidelity Wise Origin Bitcoin Fund (FBTC) has $112 million.

- Bitwise Bitcoin ETF (BITB): $60 million.

- Greyscale Bitcoin Mini Trust (BTC): $30 million.

Invesco, WisdomTree, and Franklin Templeton funds recorded smaller inflows.

This strong demand reflects institutional investors’ continued confidence, despite many retail traders remaining cautious on the sidelines.

Related: What happens if Ethereum’s $3.9 billion ETF surge keeps rolling in Q4

IBIT Nears $100 Billion in Assets Under Management

The BlackRock Bitcoin ETF is approaching a new milestone: $100 billion in assets under management (AUM).

According to Nate Geraci, President of ETF Store, the fund presently manages around $98.5 billion in Bitcoin and cash, or roughly 783,767 BTC.

To put that into context, the Vanguard S&P 500 ETF, the world’s biggest ETF, took more than 2,000 days to reach $100 billion. IBIT, on the other hand, expects to reach this milestone in under 450 days.

Only 18 of the world’s roughly 4,500 ETFs presently have more than $100 billion in assets under management.

Institutional demand fuels the bull market

The unprecedentedUS Bitcoin ETFs inflows demonstrate how institutional investors are powering the current cryptocurrency bull market. Analysts observe that, although individual investors have yet to completely recover, the impetus from huge financial players is driving Bitcoin and ETF volumes upward.

As more capital enters Bitcoin via regulated investment products, analysts believe ETF performance will play an important role in shaping the market’s next major leg up.

Source: Cointelegraph

3 thoughts on “US Bitcoin ETFs Record $1.18B Inflows, Second Highest Ever During Crypto Market Rally”