After a community vote, Native Markets, one of the groups that proposed to create and oversee the US dollar stablecoin (USDH) on the Hyperliquid cryptocurrency exchange, formally claimed the USDH ticker on Sunday.

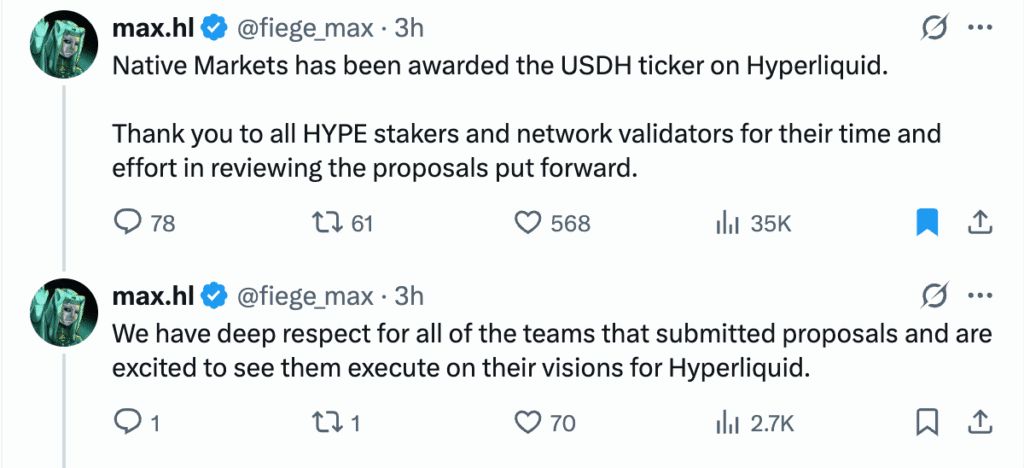

Max Fiege, the founder of Native Markets, stated in an X post that the organization will soon launch the first Hyperliquid Improvement Proposal (HIP) for USDH and an ERC-20 token, the Ethereum network’s token standard. He also described what to do next:

“The USDH/USDC spot order book will open after a testing period for mints and redeems up to $800 per transaction with an initial group. This will be followed by uncapped mints and redeems.”

After synthetic stablecoin issuer Ethena withdrew from the competition on Thursday, Native Markets’ chances of winning the ticker surged to over 99% on Saturday on prediction market Polymarket.

Source: cointelegraph

The cryptocurrency community and business leaders eagerly monitored the USDH bidding battle, which sparked claims of a rigged selection process and discussions about the stablecoin industry’s overall future.

Hyperliquid’s USDH bidding battle provokes discussion and criticism.

Executives within the cryptocurrency sector had conflicting feelings about the USDH bidding process and the vote’s result, which saw a newcomer defeat well-established stablecoin, cryptocurrency, and payment companies.

Haseeb Qureshi, managing partner of Dragonfly, a venture capital firm, stated on Tuesday that he was beginning to feel that the USDH RFP was a bit of a farce.

Multiple bidders have informed us that Native Markets is the only bidder that the validators are interested in taking into account. As if a backdoor deal had already been completed, the conversation isn’t even serious,” Quershi continued.

According to Mert Mumtaz, CEO of Helius, a vendor of remote procedure call (RPC) nodes, the bidding war showed that stablecoins have become commoditized.

Mumtaz predicted that in the future, exchanges will merely show front-end customers a generic “USD” and abstract away US dollar stablecoin tickers.

Binance Glitch Sends ATOM and IOTX to Zero During Crypto Crash

Mumtaz came to the conclusion that these exchanges will handle all of the work of switching the differently denominated stablecoins in the background, in a backend procedure that the user never sees or engages with.

This article is for informational purposes only and does not constitute financial advice. Always do your own research before making investment decisions.

Source: cointelegraph