Ethereum (ETH) experienced a 6.7% decline in value following what has been described as “Crypto Black Monday” by traders, according to data shared by Cointelegraph.

Despite the indiscriminate sell-off that wiped out billions from the global crypto market recently, Ethereum price performance in relation to larger financial collapses is impressive in terms of wider adoption by investors and holding better than competing altcoins.

A Brutal Day for the Market

Fear overtook both global markets and digital markets preceding the crash, as reports of new U.S. trade policies and new geopolitical tensions pushed investors into risk-off positions. In all, more than $1.6 million in leveraged traders were liquidated in the span of a single day user speculation suggested it ranked among the top liquidation days of 2025.

Major altcoins, including Solana (SOL), Cardano (ADA), and XRP, tumbled from highs between 17% and 30%, while token names even lower than this lost over 70% in worth in the span of a single day.

Ethereum Holds The Lines

Although the whole crypto market took a downturn, Ethereum held up very well in the midst of the turmoil. The asset briefly fell to around $3,510 before rebounding again toward the $3,800 price level (an important area of psychological and technical support).

From a technical perspective, ETH’s value can be seen in that the 200-day exponential moving average provided strong defense against further downside, which was an indicator that the asset would not be in much deeper trouble than the dip below 3,510 showed. In addition, ETH’s Relative Strength Index (RSI) fell near the 35 line, which indicates Ethereum price is nearing oversold territory, which could mean it is likely there will be a short-term bounce in price action.

In contrast, most altcoins broke below critical support levels, suggesting that there will still be rotation of capital back to Ethereum and Bitcoin, which are the market’s most trusted assets in volatile market situations.

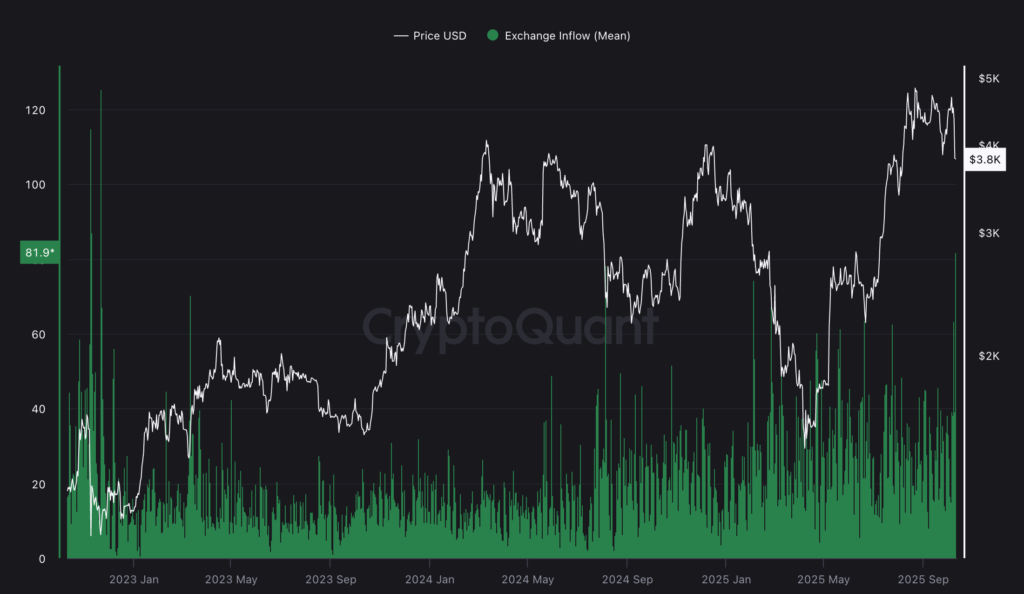

Despite ETH’s relative stability, on-chain data shows that there is a marked increase in inflows to exchanges, which can easily be interpreted to mean that traders who are holding ETH found profitable positions and decided that right now is the right time to bail. In addition, withdrawals from staking contracts have grown significantly this week such that there are now nearly $10 billion of Ethereum that is actually sitting in withdrawal queues.

If these patterns continue, it could provide added pressure to price action as the market appears to be slowly returning back to ETH and BTC.

Multiple market analysts still anticipate a possible recovery emerging after supplies are stabilized. Some forecasts estimate ETH’s medium-term target will be about $5,500, assuming macro circumstances normalize and institutional demand picks up again.

ETH Surge to $4.5K Hints Bottom Is In: Data Points to 100% Rally Ahead

Ethereum’s performance relative to the “Black Monday” sell-off has bolstered its reputation as a comparatively reliable play as compared to most altcoins, which is another attribute that could allow it to eventually regain some dominance in future bullish market conditions.

For the time being, in the aftermath of one of 2025’s harshest sell-off events, Ethereum’s stay and ability to withstand have maintained Ethereum as one of the few digital assets with existing faith from investors from around the world.