Bitcoin is rapidly matching gold as a dependable store of value, with the correlation between the two assets exceeding 0.85. Both are drawing interest from investors seeking to secure their capital in the face of growing prices and global economic instability.

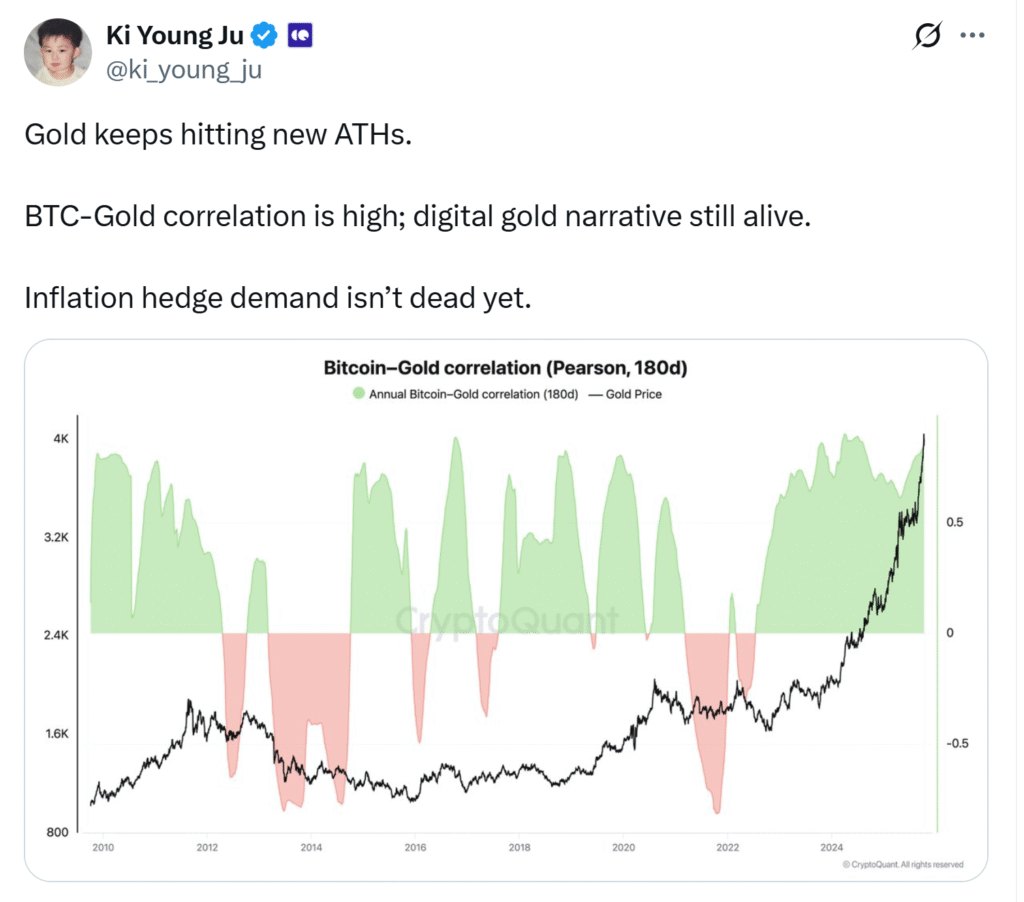

CryptoQuant CEO Ki Young Ju emphasized the rising relationship, stating that Bitcoin’s association with gold has grown as gold has risen to record highs. In a post on X, Ju said, “Gold continues reaching new all-time highs. The Bitcoin-gold link is robust, and the digital gold myth is still alive. The need for inflation hedges has not diminished.”

CryptoQuant data reveals that the BTC-gold correlation is presently over 0.85, up from -0.8 in October 2021. The connection had previously peaked at about 0.9 in April of last year.

Bitcoin Following Gold’s Footsteps

Andrei Grachev, managing partner at DWF Labs, noted that the increased connection indicates how institutional investors see Bitcoin. “Capital naturally flows into assets seen as stable stores of value,” according to him.

Grachev noted parallels between Bitcoin’s present trajectory and gold’s historical journey. Gold, formerly extensively utilized as money, gradually became the major deposit of wealth. Bitcoin, he claims, is experiencing a similar metamorphosis, which is why its price swings increasingly resemble gold’s.

According to Ben Elvidge, director of commercial applications at Trilitech and product lead at Uranium.io, Bitcoin’s current value proposition is greater as a store of wealth than as a transactional currency. “Its programmed scarcity and potential for capital appreciation outweigh its convenience for payments,” according to him.

US Bitcoin ETFs Record $1.18B Inflows, Second Highest Ever During Crypto Market Rally

Gold and Silver Hit Record Levels

Gold continues to shine, reaching a fresh record high of $4,179.48 per ounce on Tuesday. Spot gold jumped 0.5% to $4,128.49, while US gold futures for December delivery rose to $4,158. Geopolitical concerns and macroeconomic dangers have driven the precious metal’s 57% increase this year alone.

Silver also made headlines, rising to $53.60 before closing at $52.27, representing an annual gain of more than 85%—far outpacing gold’s surge. (Cointelegraph, 2025)

The rise in precious metals indicates increased interest in the so-called “debasement trade,” in which investors attempt to safeguard against currency depreciation caused by continuous money creation. Entrepreneur Anthony Pompliano recently said that institutional investors are increasingly accepting that “no one is ever going to stop printing money,” which is fueling demand for hard assets such as gold, silver, and Bitcoin.

1 thought on “Bitcoin’s Correlation With Gold Strengthens as Investors Seek Safe Havens”

Comments are closed.