Ethereum (ETH) has risen sharply after falling below $3,900, and new market data indicates that the bottom may have already been reached. With technical indications blazing positive and derivatives indicating a robust market structure, economists predict an 80-100% surge by mid-2026.

ETH finds support around $3,900

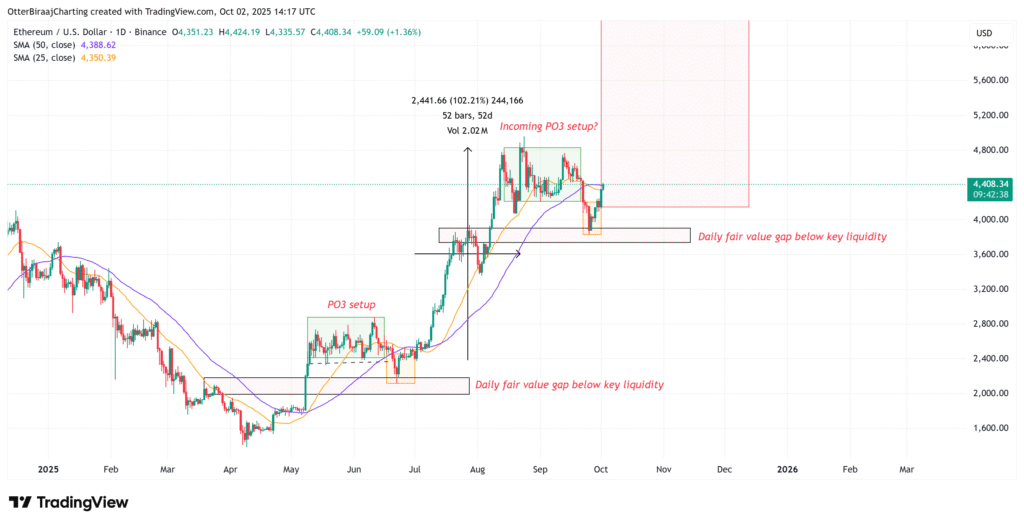

After weeks of turbulence, Ether appears to have found a local bottom right below $3,900. The comeback has been supported by a well-known trading structure known as the Power of Three (PO3) model, also known as the Accumulation-Manipulation-Distribution arrangement. This identical trend has previously fueled ETH’s rise from $2,000 to roughly $4,900 in only two months.

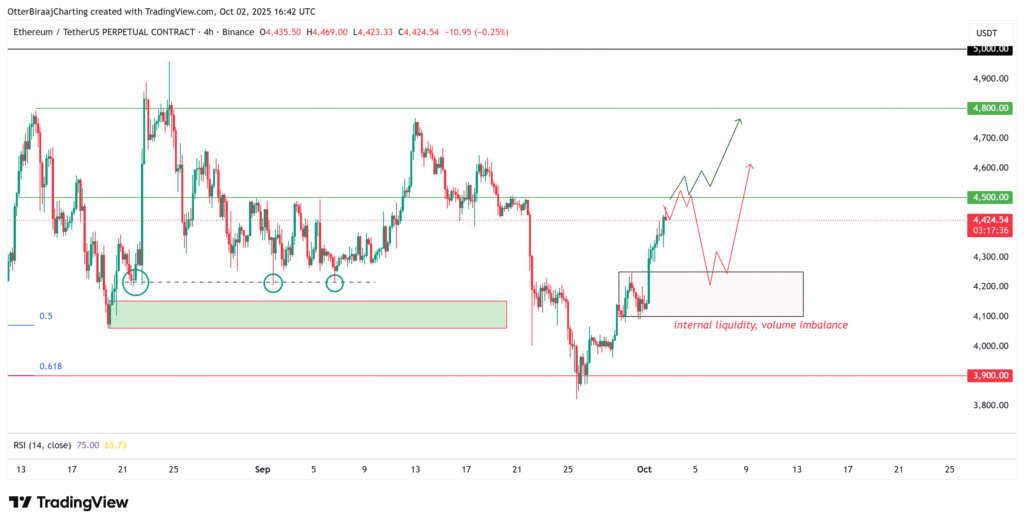

The most recent pattern had similarities: buyers established positions between $4,800 and $4,200, followed by a rapid liquidity sweep below $4,000. Market analysts saw the move as a “stop-hunt,” cleaning liquidity pockets before preparation for the next rising run. Importantly, the pullback dipped into a daily fair value gap (FVG), which strengthened the bullish thesis.

Derivatives and Spot Market Activity

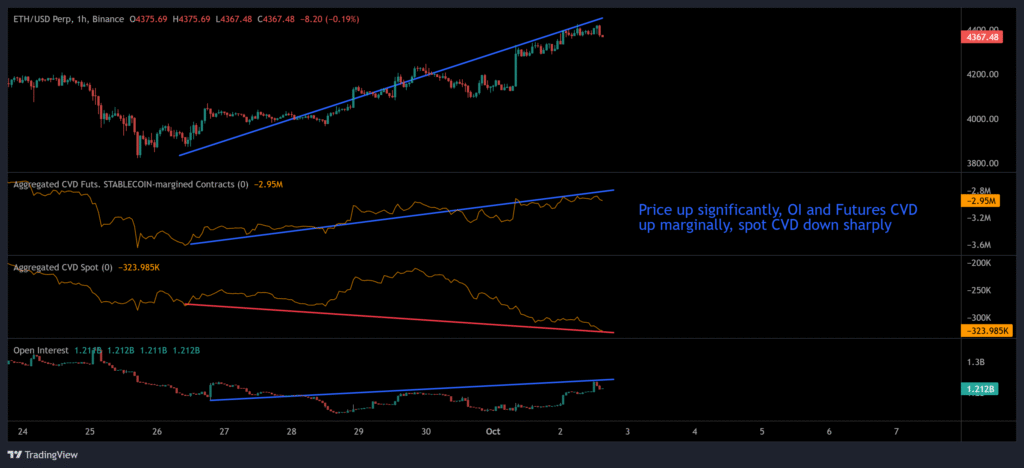

Interestingly, Ether’s current gain has not been driven by undue leverage. Despite a 15% increase in price over the last week, open interest (OI) and futures cumulative volume delta (CVD) have only slightly increased. This shows that the rise was mostly driven by spot demand rather than speculative longs, mitigating the potential of abrupt liquidation cascades.

However, spot CVD fell throughout the rise, indicating that net selling pressure has turned into strength. This disparity might indicate that major players are absorbing liquidity or distributing to retail demand, both of which often precede times of tumultuous price movement.

If absorption continues as ETH remains above $4,200-$4,400, sidelined leveraged traders may return to drive a second run higher. However, if purchasing absorption declines, the gap increases the likelihood of abrupt pullbacks when liquidity pockets are tested.

Key Levels to Watch

The $4,100-$4,250 range is essential in the near future. This range reflects a region of concentrated liquidity and unresolved volume inefficiencies, giving it a possible support base if ETH fails to maintain $4,500 on its first try.

Overall, Ethereum’s recovery is gaining legitimacy. As long as the $3,900 floor holds and momentum builds, ETH might be poised for a strong move possibly one of the largest rallies since its last cycle highs.

Source: Adapted from reporting by Cointelegraph

Stay up to date on crypto news, updates, and market analysis by visiting TheCryptotrendnews

5 thoughts on “ETH Surge to $4.5K Hints Bottom Is In: Data Points to 100% Rally Ahead”